Banking service provider needs more specific way to make them stay closer with their customers

Today, technology has changed the current banking industry

The banking sector has embraced the use of technology to serve its client’s faster and also to do more with less. Emerging Internet technologies have changed the banking industry from paper and branch-based banks to” digitized and networked” banking services. Bank customers are becoming very demanding and it is the extensive use of technology that enables banks to satisfy adequately the requirement of the customers. Use of advanced technology has led to the shift from traditional banking methods to modern banking methods. Currently, the most common and useful technology-based banking methods are online banking, mobile banking, video banking, telephone banking, ATMs, virtual currencies and so on.

Today, the concept of core banking has made “anywhere and anytime” banking a reality. Along with technology, banking service have also evolved and the delivery of various banking products are carried out through the medium of high tech at a fraction of cost to the customer

E-banking/internet banking is not enough to meet bank customers’ need and expectations

A study by Cisco Consulting Services found evidence that while bank customers across virtually all age groups want increased digital interaction from their financial institution, they also desire a more personalized experience that makes them feel more connected to and engaged by their financial institution. Cisco reports that 43% of customer feels their banks don’t understand their needs, and 31% say their banks don’t help them reach their primary financial goals.

Unified-communication for digital bank 4.0

One such product is E-banking/internet banking, which is gradually replacing the traditional branch banking. It is the latest and innovated service and is the new trend among the customers. It offers new opportunities for banks to provide added convenience to their existing customers. A significant use of Internet banking is it allows one to make real-time payment, settlement of funds, wealth management, customer service or account verified by unified communication technology.

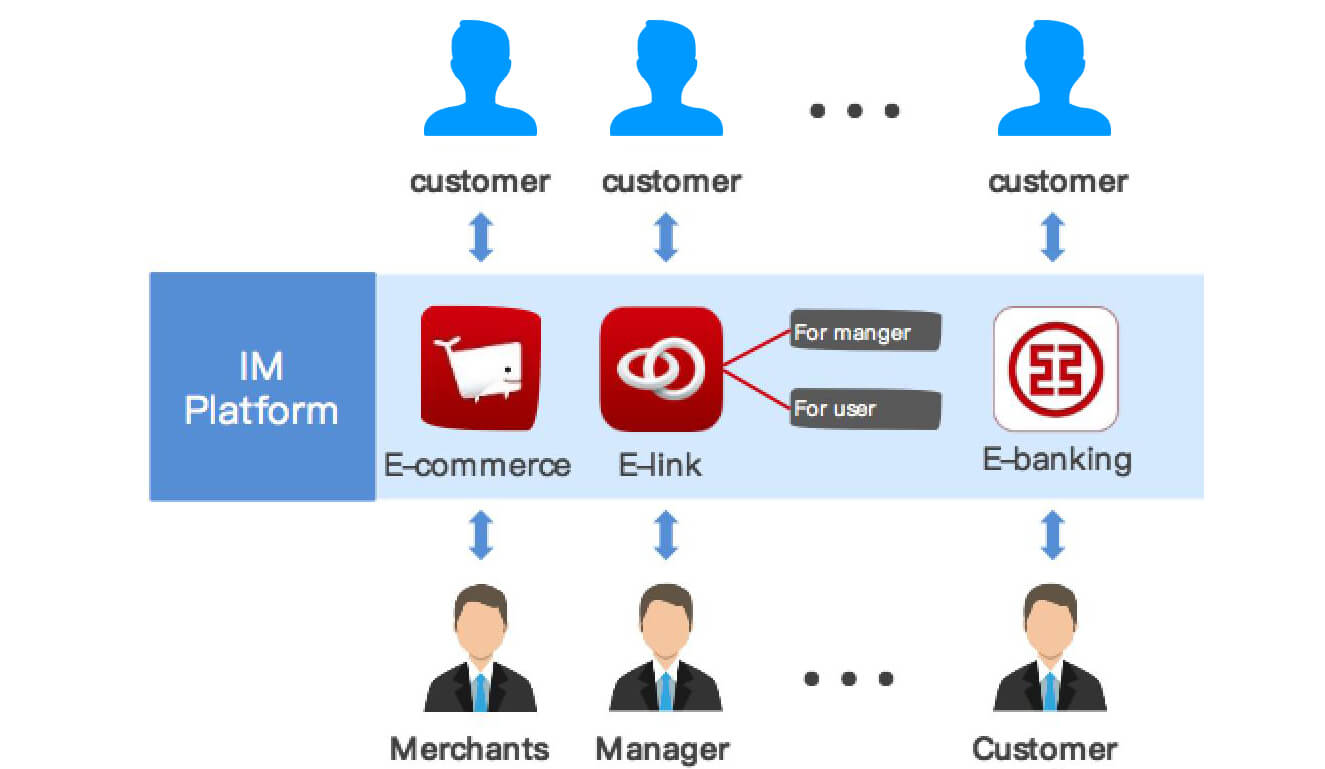

As the underlying communication platform of banking services, it is used to support bank customers to launch different types of communication services, such as social networking, online customer service, message notification and so on. After using the unified technology communication platform, we can use this platform to realize IM social, audio and video social, IM customer service, video customer service, and intelligent customer service in different apps. It is creating a unified process for customer interaction and support the realization of all-day business scenarios.

RongCloud is helping ICBC (Industrial and commercial Bank of China) to be the most popular E-banking service in domestic market

ICBC launched the e-finance strategies in 2015, which is based on service of “E-Banking”, “E-Link” and “E-Commerce”. All three products are based on the integrated communication service of RongCloud platform. In fact, the entire solution brought values on ability of communication experience between bank to customers, and gaining more stickiness of service and differentiated advantages from revivals. In the future, ICBC will continue to build more business scenarios on this communication-based ecosystem, and gradually develop into a social-based financial service as more secure and comprehensive.

Based on instant messaging system of ICBC, ICBC has built a client of E-link (financial SNS) and E-commerce (e-commerce); it plans to target 350 million users of ICBC, and currently has 30 million registered users.

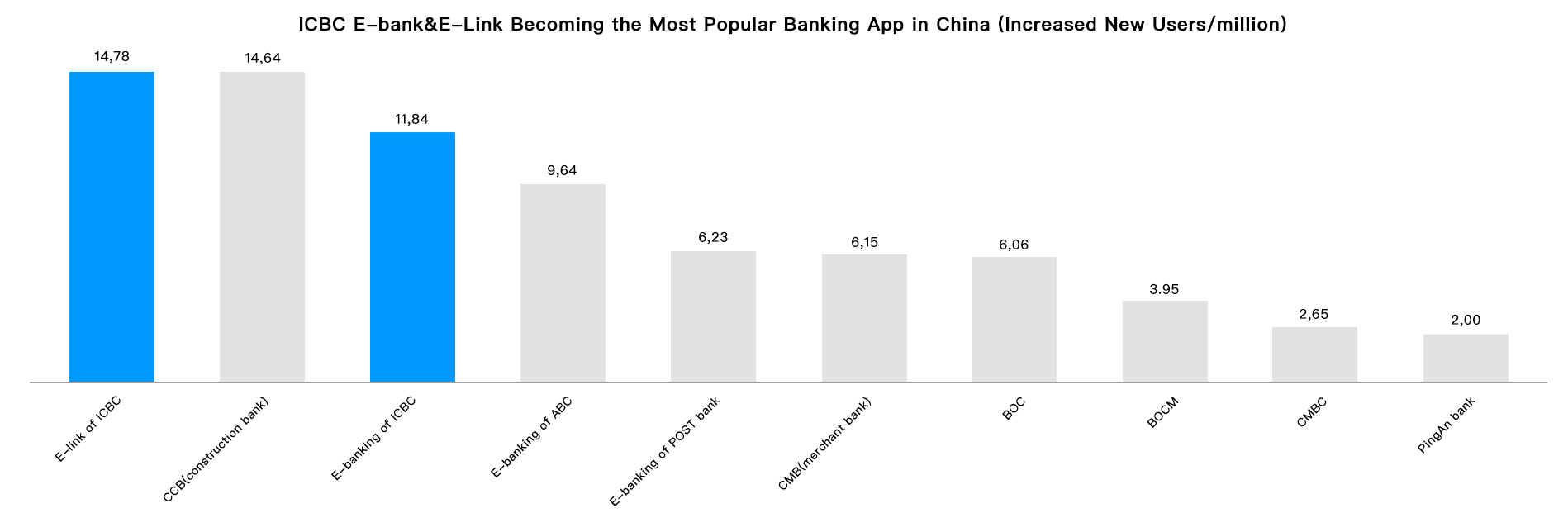

RongCloud made ICBC as the top player in E-banking industry of China

- User based: 70 million users

- Increasing result: 14 million users increased by the first half of year

- Ranking: top increasing app in the bank industrial apps

- Active user base of e-Links: over 21 million/monthly active, 6 million of DAU

The fundamental goal of bank transformation is to maintain good sustainable profitability. The most intuitive result is the valuation premium in the capital market. The key elements to achieve this goal are scale, growth, structure, technologies, efficiency and quality. In the context of the Internet+, the core of the transformation of banking business is actually more of the process of Internet transformation of some existing businesses.